GTA - Global Tax Application

"In view of the implementation of the “Automatic Exchange of Information” and of the banks' concern to have their clients considered as “tax compliant” there is an increasing need for Tax Engines that help banks to deliver country specific tax reports"

We specialise in building global Tax calculation and Reporting solutions for Wealth Management with the following features

- Fully Customisable: Ability for Tax Experts to configure country specific rules and the desired output in a relatively short amount of time

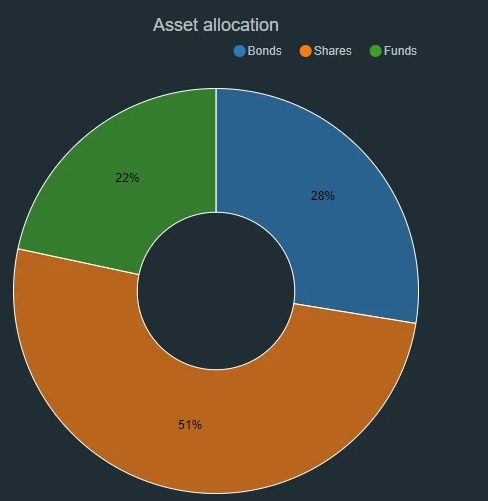

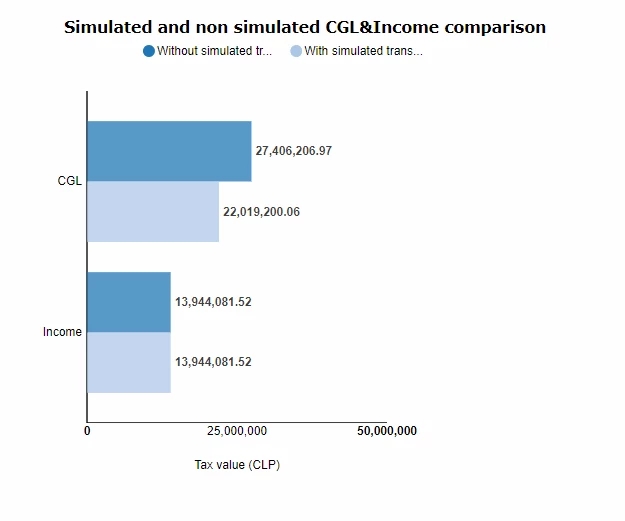

- Report Types: Capital Gains and Losses, Income, Asset and detailed Transaction reports

- Tax Calculation Rules: FIFO, LIFO, WACP and Period/Asset based mix and match rules

- Corporate Actions: Corporate actions management and processing module

- Transfer Module: Support for handling internal and external Transfers

- Tax Simulation: "What if" tax scenario simulation for advisory services and Portfolio analysis for tax optimisation

- Workflow: Support for customisable workflows for business process management and control

- Data Management: Full data management with business specific data cleasning and exception management rules

- Rich user experience: Intuititive and easy to learn user interface developed as per corporate standards

- Adapters: Standard adapter development framework for various internal, market and trade data sources

- Output Formats: Support for output in PDF, Excel, CSV and XML

- Official Tax Forms: Ability to automatically fill country specific tax forms

- Multi Device Support: Browser, Anderoid and iOS

- Authentication and Authorisation: Support for SSO and fine grained access control as per clients requirements

To find out more and arrange for a demo please reach us at contact@talteksystems.com